Content

Taipei

TEL:+886-2-2557-5607

Taichung

TEL:+886-4-2320-2793

Shanghai

TEL:+86 21-6090-4391

Shenzhen

TEL:+86 755-83176807

Southeast Asia Company

Foreign investment in the establishment of companies in the Philippines can be classified into three types: sole proprietorship, partnership, or corporation.

Foreign companies can also establish companies, branches/subsidiaries, or representative offices in the Philippines. When setting up a company in the Philippines, the minimum registered capital required for foreign investment is USD 200,000; for representative offices, the minimum registered capital is USD 30,000. In the case of a partnership, the minimum registered capital is PHP 500,000.

Net profit remittances are subject to a withholding tax rate of 30% (currently, exemptions are available for investments in Subic Bay Freeport Zone and economic zones). Foreign companies investing in the establishment of a local company in the Philippines must first register with the local Securities and Exchange Commission (SEC). If clients are interested in setting up a company in Manila, Philippines, they can consult InterArea for related inquiries.

I. Types of companies for foreign investors to set up companies in the Philippines

Wholly foreign-owned subsidiary:

Foreign investors can set up subsidiaries with independent legal personalities in the Philippines and can be 100% foreign-owned. The Philippine company only needs to appoint a local secretary and must pay attention to the foreign investment negative list (FINL) when setting up, the laws of the Philippines allow foreign investors or companies to do business in the country. The Constitution and some specific laws also implement the Foreign Investment Negative List (FINL) to restrict foreign equity participation in regulated industries and areas of business activity exclusive to Filipino citizens.

Joint venture company:

If the business project involves the scope of FINL, foreign investors in some business projects may form a domestic partnership with Filipinos according to the shareholding ratio stipulated by law. If 60% of the shares are held by locals and 40% by foreign investors, it is regarded as a local company; if foreign investors hold more than 40% of the shares, it is regarded as a foreign company. The law has corresponding protection measures for foreign investors with small shareholdings. The law stipulates that there shall be no less than 3 and no more than 15 shareholders. A registered Philippine company should have a general manager, a financial officer, and a secretary. The secretary must be a Filipino citizen, and the financial officer must also be a local resident. The amount of capital depends on the company's business scale and projects, and it is generally recommended to be at least 1 million pesos or more. Projects not included in FINL are 100% open to foreign investment. The registered capital should be at least USD 200,000. The capital does not need to be in place immediately, depending on the actual business needs of the company.

Foreign branch:

Setting up a branch in the Philippines to engage in the business activities designated by the headquarters does not have the status of an independent legal person. A branch of a foreign company registered to do business in the Philippines must obtain a license from the Securities and Exchange Commission upon incorporation. Documents related to the foreign company must prove its legal existence for verification. The parent company must appoint a resident agent for local tax law-related matters who should handle subpoenas and other legal proceedings against the branch. A resident agent can be an individual residing in the Philippines or a domestic company legally conducting business there. The minimum registered capital for setting up a Philippine branch is at least US$200,000, with actual funds required, but this can be reduced to US$100,000 if the activities involving technology will be performed or if at least fifty (50) employees will be employed. If it is an export-oriented business applying to export more than 60% of its total sales, it can be registered for as little as 5,000 pesos.

Representative Office:

A representative office is a non-operating entity that needs to be remitted by the parent company with a capital of at least US$30,000 and is established in the form of an office in the Philippines of the foreign parent company to delegate its administrative and technical operations, such as: >Promote company services/products. >Convenient for customers to order from abroad. > Quality control of export products. The representative office is not a local independent legal entity and its liabilities are borne by the head office from abroad. Do not provide business conduct to customers or third parties in the Philippines.

II.Business projects that allow foreign investment in the Philippines

- The investment regulations concerning the Philippine investment environment for foreign investors to register companies are mainly the “Foreign Investment Act” formulated by the Philippine Congress in 1991, which became Republic Act No. 7042, which was passed on March 28, 1996, as Republic Act No. Amendment 8179, revised and published every two years.

- The regulations allow foreign investment to enter the Philippines freely, and restrict foreigners from investing inequity in the form of FINL. Except for FINL industries, other industries are open to foreigners.

- The investment environment of the Philippines does not restrict the ownership of foreign companies, and foreign capital can freely enter industries other than FINL. Check the latest FINL for Philippine companies. Lending, financial, and investment that previously restricted foreign equity holdings have all been opened.The Philippines is poised to promote economic reforms to enhance foreign investment attraction!

III.The basic process of setting up a Philippine company

Foreign investors who want to invest in a registered company in the Philippines must first confirm and retain the company name with the Philippine Securities and Exchange Commission (SEC).

After confirming all investment information, submit it to the SEC to complete the registration to obtain a business license.

Those who intend to obtain awards from the BOI must register with the BOI; those who intend to set up factories in the processing export zone must register with the Philippine Special Economic Zone Authority (PEZA);

Those who intend to set up factories in Subic Bay must register with Subic Bay The SBMA registration is slightly different depending on the city in which the Philippine company is established.

- The basic registration process is as follows:

- Securities and Exchange Commission (SEC):

Joint-stock companies and partnerships keep their business names and apply for registration. - Apply for district-level and municipal-level commercial licenses.

Obtain district-level business license and mayor’s office permit documents. - Bureau of Internal Revenue (BIR):

Apply for a Certificate of Registration (COR) and TIN with the Bureau of Internal Revenue (BIR) and apply for official company receipts, sales invoices, and other commercial invoices. - Opening a bank account

Open Philippine Corporate Peso and Foreign Currency Accounts. - Social Security System (SSS):

Obtain an employer social security number. - Registration of the Philippine Health Insurance Company:

Obtain membership in the government health insurance system.

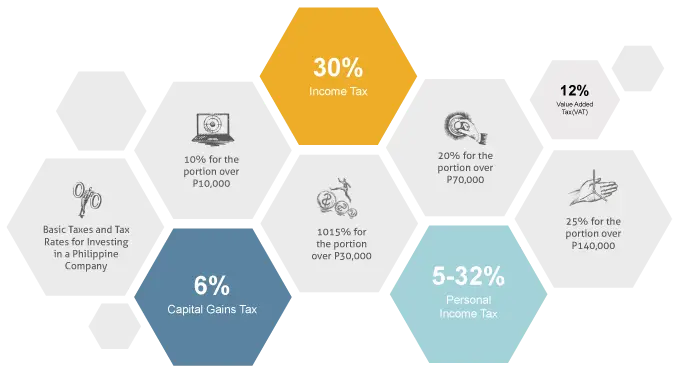

IV.Basic Taxes and Tax Rates for Philippine Companies

(1).Capital Gains Tax 6%

Capital gains tax is the tax levied on the seller’s deemed gain from the sale, exchange or other disposition of assets of a Philippine company. CGT is not levied on the part of the profit, but on the total price.

(2).Income Tax 30%

Corporate income tax for Philippine corporations refers to annual profits generated by property, profession, trade or office or taxation of personal income, remuneration, profits, etc.

(3).Value Added Tax (VAT) 12%

VAT is the sales tax levied and collected in the course of a transaction or business by the seller on each sale of property, goods, or leases of property to an individual or service provider. This is an indirect tax, so it can be passed on to the buyer.

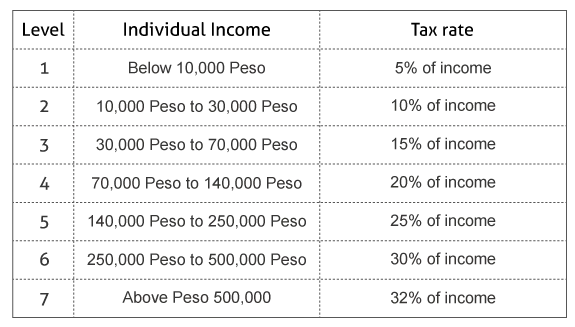

(4).Individual Income Tax

The personal income tax rate ranges from 5% to 32%, as detailed below:

V.Residence visa acquisition and related regulations and procedures

If you are not relocating to the Philippines, but wish to remain there for more than 30 days, you will need to obtain a non immigrant (temporary) visa.

Generally, non-immigrant visas are for the duration of stay in the Philippines for a specific purpose.

Foreigners entering the country are eligible for the following visa categories:

(1).Non-immigrant visa

1. Temporary Visitor Visa – General Tourist/Business Travel.

2. Temporary Visa – Transit.

3. Treaty Trader/Investor Visa – For foreign businessmen who conduct trade or commerce between the Philippines and its country.

4. Diplomatic Visa – Foreign officials recognized by the Philippine government, family members, waiters, servants, and employees.

5. Student visa – foreign students studying in educational institutions recognized by the local government.

6. Pre-arranged employment visas – for pre-arranged employees and their dependents.

【A work visa to enter the Philippines to engage in a legal occupation. The application must show that the foreign employee’s services are indispensable to the management and operation of the local or local enterprise, and the company must apply for this visa on behalf of the employee. If the duration of stay is less than six months, an application for a special work permit can be submitted to the authorities. If the transfer is longer than six months, the transferee should apply for an Alien Employment Permit (AEP). The AEP is valid for 1 year unless a longer term is available from employment contracts, consulting services or other means of participation or tenure of electoral staff. In addition to the “Foreign Employment Permit”, foreigners must obtain a temporary work permit before being approved for an employment visa. Issued by the Immigration Bureau, usually valid for 3 months. 】

(2).Investment Residency Visa

The special investment residency visa is divided into two types: Special Investor’s Resident Visa and Special Resident Retiree’s Visa. Investor immigrant remittance proof must not be less than $75,000. Eligibility for retirement immigrants: foreigners over the age of 50 have a deposit of US$20,000 (if they have a pension, they only need to deposit at least US$10,000), or foreigners aged 35 to 49 have a deposit of US$50,000.

(3).Regulations on the employment of foreign employees in the Philippines

Foreign-funded companies applying for foreign employees must first apply to the Philippine Department of Labor and Employment to obtain a work permit before applying for an occupational visa to the Immigration Bureau. Required documents include:

1. Outlook for work.

2. Labor contract.

3. Employer’s Plan.

4. The validity period of the Alien Residence Permit is 5 years.

VI.InterArea provide the following services for business registration in the Philippines:

- Confirmation of investment method and company type.

- Advice on registered capital.

- Assistance in opening local bank accounts.

- Acting as Company Secretary, Resident Agent and Nominee Partner.

- Processing documents with government agencies (SEC, BOI, PEZA, BIR, SSS, etc.)

- Additional business requirements for the specific business structure you plan to register.

- With years of practical business experience in setting up physical companies, Inter Area provides customers with integrated services for Philippine company registration in major cities such as Manila and Makati.

- Inter Area allows investors to focus on operating business in the local area and can put themselves in the shoes of customers The various affairs of setting up a company in the Philippines allow investors to focus on business market development and do not have to worry about industrial and commercial affairs.