Content

British Virgin Islands Company Registration

The British Virgin Islands...

Hong Kong Company Registration

Hong Kong offers various incentives suitable for...

Taipei

TEL:+886-2-2557-5607

Taichung

TEL:+886-4-2320-2793

Shanghai

TEL:+86 21-6090-4391

Shenzhen

TEL:+86 755-83176807

Singapore Company Registration

Singapore company type

At present, foreign companies register companies in Singapore, and most of the registered forms are private limited companies, which are also the most popular business entities in Singapore.

The maximum number of members of a private limited company is 50, and shareholders and directors have separate legal person status.

This means that the responsibility of each shareholder of the Singapore company is limited to its share capital. Limited liability for the company's debts and losses. The name of a private limited company usually contains the words "Pte Ltd" or "Ltd".

Ⅰ. Introduction to Singapore

- Singapore has a sound legal system, well-developed infrastructure, and enjoys a high level of international reputation. It also maintains good relations with neighboring countries.

- Singapore provides a highly favorable business environment for local enterprises and is one of the most competitive economies in the world.

- Singapore has one of the world’s simplest and most rational tax systems. It does not impose taxes on capital gains or dividends received from businesses. This makes the country particularly attractive for entrepreneurs looking to establish new ventures.

Ⅱ. Advantages of setting up a Singapore company

- Singapore’s economy is characterized as export-oriented and it is globally renowned as a hub for re-export trade and finance. Attracting investments is a fundamental policy of the country.

- In the World Bank’s “Doing Business” report, Singapore has consistently ranked first for eight consecutive years and has also performed well in other investment environment evaluation indices. The attractiveness of Singapore’s investment environment can be attributed to the following factors:

Excellent location

Located at a crucial maritime chokepoint and equipped with a natural deep-water sheltered harbor, it is globally renowned as a major transshipment trade hub.

Various Financing Channels

Singapore is a globally renowned international financial center and a key hub for global capital.

Clean and Efficient Government

The Singapore government is renowned for its efficient and clean reputation, providing prompt and efficient services to foreign investors in a relatively fair investment environment.

Political and Social Stability

Singapore enjoys a high level of social security and is one of the countries with the lowest crime rates in the world. It also maintains a stable social and political environment.

Extensive Business Network

Singapore has a high degree of industry structure optimization, covering a wide range of diverse industry types, providing ample investment opportunities.

Sound Legal System

Singapore has a sound legal system and a comprehensive appeals system, providing investors with legal protection.

Preferential Policy Support

Singapore has implemented various preferential policies to promote economic development, and foreign companies can generally enjoy the same benefits as local enterprises.

Perfect Infrastructure

It has the busiest container terminal in the world, the airport with the best service, and the most extensive broadband Internet system and communication network in Asia.

Ⅲ.What are the advantages or functions of registering a company in Singapore?

- Registering a company in Singapore is quick and easy, thanks to clear and comprehensive company laws. What are the advantages of incorporating a company in Singapore? What are the benefits and features? The main advantages are as follows:

- Applying for a Singapore visa:The company can apply to the Ministry of Manpower (MOM) in Singapore for an Employment Pass (EP) on behalf of one or more foreign executives planning to relocate and register a company in Singapore.

- Ability to conduct local business, apply for Singapore Customs registration for import and export activities, and issue GST invoices.

- Ability to legally hire Singaporean employees and enroll them in CPF employee insurance.

- Good international reputation and not considered a tax haven.

- Its membership in ASEAN makes it highly suitable for reinvesting in Southeast Asian countries.

- It offers low tax burdens and various tax incentives, making it suitable as a operational headquarters for multinational corporations.

IV. Singapore tax system and tax rates

- For many reasons, investors choose Singapore to start their business.

- The reason is that apart from easy creation and comprehensive cross-border business support, another major determinant is Singapore’s tax system with attractive corporate and personal tax rates, tax relief measures, no capital gains tax, a primary tax system, and extensive double taxation. Famous for tax treaties.

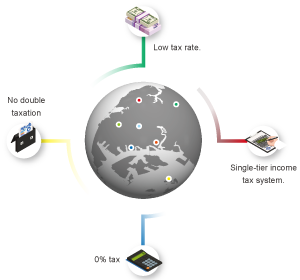

- Singapore company tax characteristics are as follows:

- Single-tier income tax system:

Since January 1, 2003, Singapore has implemented a single-tier corporate income tax system, which means that stakeholders do not need to levy double taxation. The tax paid by the company on its taxable income is the final tax, and the distribution of after-tax profits (dividends) to shareholders is tax-free.

- No tax:

No tax on capital gains, dividends, or income from overseas sources. No tax is levied on inherited or gifted assets.

- Low tax rate:

low corporate tax rate (the highest tax rate is 17%) and personal tax rate (the highest tax rate is 22%), and through the tax exemption and incentive plan provided by the Singapore Government, the effective tax rate of the company may be greatly reduced.

- No double taxation:

The extensive avoidance of double taxation and more than 80 tax treaties with other countries means that companies and individuals that benefit from foreign income and assets only need to be taxed once. Income from tax treaty countries can avoid double taxation through foreign tax credits granted under these treaties. For non-treaty countries, unilateral tax credits are granted to all foreign sources of income.

- In Singapore, capital gains are tax-free.

- When investing in emerging industries, research and development, and productivity-enhancing technologies, Singapore offers generous incentives and tax breaks.

- Certain types of foreign-sourced income are exempt from tax in Singapore.

- Singapore follows the geographical basis of taxation and adopts a local tax system. In other words, companies and individuals are mainly taxed based on Singapore-sourced income.

V. What are the types of Singapore company establishment?

Singapore’s company law allows for the creation of various types of business entities, including sole proprietorships, various types of partnerships, public limited companies, and private limited companies. Among them, the most common type of company formed in Singapore is the private limited company.

- Private Limited Company

A private limited company, or simply a private company, is a typical legal entity that is separate from its shareholders and directors. Due to this distinction, the shareholders of a private limited company are not personally liable for debts and losses beyond their investment in the company’s share capital.

A private limited company can sue or be sued, and it can own property in its own name. The shares of a private limited company are not offered to the public but held privately. Singapore’s company law allows for a maximum of 50 shareholders in a private limited company. Such companies allow for 100% local or foreign ownership.

- Subsidiary Company

A subsidiary company is also a private limited company that is a separate legal entity from its parent company. This also means that the parent company is not directly responsible for the debts or legal actions taken by the subsidiary company.

Singapore company law allows for 100% foreign ownership; therefore, foreign companies can own all the shares of a subsidiary company or share ownership with a local entity or another foreign company. The subsidiary company is required to submit its own annual declaration, and it is not necessary to submit the annual declaration of its parent company.

- Exempt Private Company

Exempt Private Company (EPC) is a private limited company in which its shares cannot be directly or indirectly held by any corporation.

To qualify as an EPC, a registered Singapore private limited company must meet the following criteria: the number of shareholders must not exceed 20; no company should have beneficial interests in its shares—there should be no corporate shareholders.

EPCs have greater freedom and autonomy when obtaining or providing financial loans.

VI. Required Documents for Singapore Company Registration

- Company Name:

Clients are required to provide the proposed company name, which must be in English. The registered name of the company should not be in Chinese characters and should end with “Private Limited” or “Pte., Ltd.” in English.

- Shareholders:

Shareholders of a Singapore company can be individuals or corporations. There are no restrictions on the shareholding percentage for foreign investors, allowing both foreign individuals and entities to hold 100% of the shares in a Singapore company. The company can have 1 to 50 shareholders, who may also serve as directors.

- Directors:

Directors must be natural persons and cannot be corporate entities. The company must have at least one resident director who is either a Singapore citizen, a Singapore permanent resident, or an Employment Pass holder. In practice, companies often have two directors, one being a foreign director and the other being a local director.

- Company Secretary:

According to Section 171 of the Companies Act, every Singapore incorporated company must appoint a local secretary who is a member of the Singapore Association of Company Secretaries.

- Registered Capital:

There is no specific requirement for the registered capital of a Singapore company. The standard amount of registered capital for most companies is SGD 100,000. However, if the registered capital exceeds SGD 500,000, an additional application fee will be incurred, which includes the membership fee for joining The Singapore Business Federation (SBF).

VII.Notes on Singapore company registration

Considerations to Avoid When Registering a Singapore Company:

- Same as existing business (especially within the same industry).

- Bad names, considered vulgar, obscene, or offensive.

- Prohibited by order of the Minister of Finance.

- The establishment of a Singapore company cannot issue bearer shares.

- Appoint at least one director who must be a legal resident of Singapore and have at least one shareholder. Shareholders and directors can be natural persons or legal persons.

- Appoint at least one company secretary within half a year after incorporation.

- Information on company directors and shareholders established by a Singapore company must be kept in the office and available for public inspection.

- The establishment of some industries and companies in Singapore, such as banking, insurance and securities brokerage companies, requires special permits before establishment. In the production of certain goods, such as cigars and firecrackers, special licenses must be applied for in advance.

- The registered address of the company must be a local physical address in Singapore, which can be a residential address or a business address, but not a post office box.

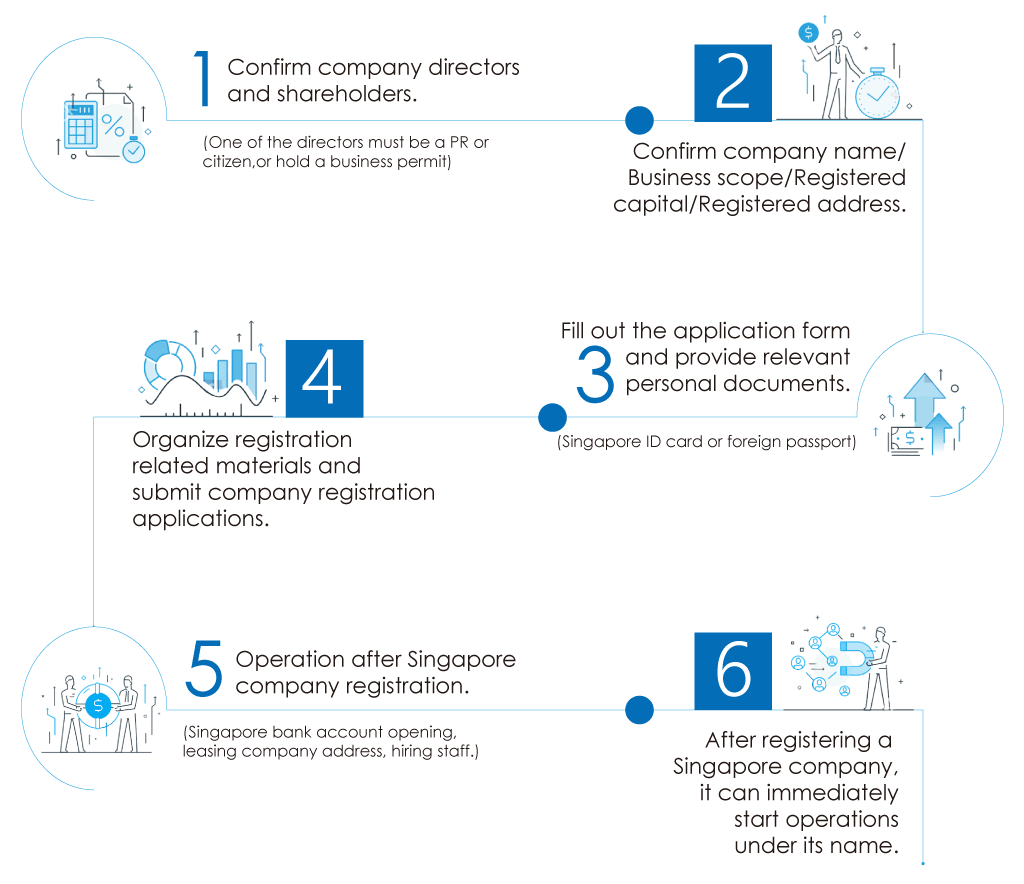

VIII. Process of Singapore Company Registration

- The following are the five steps for Singapore company registration:

- Confirm company directors and shareholders.(one of the directors must be a PR or citizen)

- Confirm company name / business scope / registered capital /registered address.

- Fill in the application form and provide relevant personal documents.

(Singapore Identity Card or Foreign Passport) - Organize registration-related information and submit the company registration application.

- Singapore company operation after registration.

(Bank of Singapore account opening, leasing company address, hiring employees) - After registering a Singapore company, it can immediately start operations under its name.

1.Confirm company directors and shareholders. (one of the directors must be a PR or citizen).

2.Confirm company name / business scope / registered capital /registered address.

3.Fill in the application form and provide relevant personal documents. (Singapore Identity Card or Foreign Passport)

4.Organize registration-related information and submit the company registration application.

5.Singapore company operation after registration. (Bank of Singapore account opening, leasing company address, hiring employees)

6.After registering a Singapore company, it can immediately start operations under its name.

IX. Singapore registration service items

The Singapore government requires the use of agency services to set up companies. As the international operation can better analyze policy dynamics and predict market demand, in addition to basic company registration and tax functions, Inter Area has been working hard to expand. Inter Area provides more local integrated services to enterprises and individual investors.

The following are related professional services provided by Inter Area.

Professional service items:

- Provide Singapore company registration

- Provide Singapore local director

- Provide Singapore local secretary

- Provide Singapore account opening assistance

- Provide Singapore document certification

- Provide Singapore company registered address

- Provide company accounting services

X. How to register a Singapore company? Frequently Asked Questions | Q & A

Q1. Can a foreigner own 100% of the shares in a Singapore company?

A: Yes, the shareholders of a Singapore company can be foreign individuals or companies, and they own 100% of the shares of the Singapore company.

Q2. How long does it take to register a Singapore company?

A: The Singapore company has certain procedures and steps. If the information is complete, the company can be established in about 1-2 weeks.

Q3. Must a Singapore company appoint a local director?

A: Yes, if you do not have a suitable candidate, Inter Area can provide an local director.

Q4. Do Singapore companies have to appoint a company secretary?

A: Yes, every Singapore company must appoint a company secretary. The company secretary must live in Singapore and understand Singapore company laws.

Q5. Can a director of a Singapore company serve as the company secretary at the same time?

A: Yes. One person can serve as director and secretary at the same time, but if you have only one director in Singapore, the sole director cannot serve as company secretary.

Q6. What activities can a Singapore company business engage?

A: There is no restriction on the types of business activities that Singapore companies can engage. However, some business activities such as travel agencies, recruitment agencies, financial companies, schools or other regulated industries need to obtain licenses from relevant departments before they can operate.