Content

Taipei

TEL:+886-2-2557-5607

Taichung

TEL:+886-4-2320-2793

Shanghai

TEL:+86 21-6090-4391

Shenzhen

TEL:+86 755-83176807

In the initial stage of business establishment, the benefits of cost optimization are self-evident.

Among them, how to handle the optimization of financial work costs such as finance and taxation is a problem considered by many entrepreneurs.

Some people entrust the financial work to a professional accounting agency, while others entrust the financial and tax work to a friend who is an accountant or part-time financial staff.

I.What is accounting and tax Outsourcing? (Bookkeeping)Why is it important?

Bookkeeping is the daily process of recording a company’s finances into organized accounts and is an essential part of a business’ accounting process.

When transaction records are updated, accurate financial reports can be generated that help measure business performance.

Detailed records can also be handy when conducting tax audits. Companies are also able to track all information on their books to make key operational, investment, and financing decisions.

Accurate bookkeeping is also critical for external parties, such as foreign investors, financial institutions, or governments. Helps owners understand the health of their business and measure their performance by generating financial statements such as balance sheets, profit and loss statements, and cash flow statements. to this end.

Getting your small business bookkeeping right is crucial. Here are a few reasons why bookkeeping is so important:

- Separating business and personal finances ensure that you are not personally responsible for any debts or problems related to your business.

- Detecting errors early by managing transactions and reconciliations can avoid financial problems later on.

- Streamline business finances by streamlining tax processes and working with tax professionals to save money.

- Keeping a close eye on business financials can identify ways to improve or change processes.

- Organizing documents and records can simplify processes such as applying for a business loan or purchasing new equipment.

II.Why do you need to outsource accounting and tax?

- Accounting and tax outsourcing is to hand over the company’s financial affairs to a professional financial agency company. Due to the relatively low cost of accounting standards, it is adopted by the vast majority of small and medium-sized enterprises and start-up enterprises.

- Proper bookkeeping allows companies to reliably measure their performance. It also provides information for decision-making and benchmarks for revenue and revenue goals. Once a company is established and registered for tax purposes, monthly filings are required even if there is no business activity, and once the business is up and running, it is even more crucial to spend extra time and money maintaining the correct records.

- For cost reasons, many small companies don’t actually hire full-time accountants to work for them. Conversely, smaller companies often hire bookkeepers or outsource the work to a professional firm. Outsourcing agency bookkeeping can save the cost of hiring specialized accountants, and related financial work will not cause incomplete accounting or even data leakage due to changes in the company’s accountants, and it can also respond to changes in local tax policies. loss and tax risk.

III.What are the advantages of accounting and tax outsourcing?

- Modern bookkeeping agency has developed into an important part of modern service industry based on and core of accounting, supplemented by high value-added services such as taxation, industry and commerce, financial management consulting, and tax planning. Outsourcing accounting and taxation to an agency has the following advantages.

- Save the cost of hiring accountants.

- Reduce the additional burden of the enterprise (insurance, welfare).

- Keep account confidentiality.

- Financial work continues uninterrupted.

- Instant and accurate tax declaration.

- Immediately respond to local tax situation.

- Diversified information flow.

IV.Bookkeeping service content and process

Transnational investment activities are becoming more and more active.

Entering the capital markets of different countries must follow local accounting standards.

Through accounting and tax outsourcing services, a complete and complete internal control system and a sound financial management mechanism can be established to make local taxes comply with laws and regulations., Reduce fiscal and tax risks, and ensure that customers can focus more on core market/product and business development.

The service provided by accounting and tax outsourcing is the accounting treatment for customers, including industry and commerce, taxation, banking, etc. To a large extent, the outsourcing unit is equivalent to the company’s financial department.

For financial outsourcing, the services provided are not only the overall finance, but also general ledger accounting, current account management, payroll management, tax declaration, as well as cashier, bookkeeping, financial analysis, etc.

The basic services are as follows:

- Bookkeeping agency will prepare financial statements in accordance with local accounting standards and corporate accounting systems.

- Review original vouchers, fill in bill vouchers, register accounting books, prepare accounting statements, fill out and declare tax returns (tax declaration), and provide financial guidance such as buying invoices, tax officer training, deduction agreements, and Buy stamps duty, and USB shield, etc.

- Agency bookkeeping services include monthly and annual declaration services for various taxes (value-added tax, business tax, personal income tax, etc.), corporate income tax compliance declaration, and monthly tax declaration for the company.

- Fiscal and tax policy transmission, daily telephone free answering questions, etc., assist the company to deal with general problems in taxation, communication, and coordination

- Establish a sound financial internal control system.

| Bookkeeping Standard Process |

Establish Accounts

Establish

Accounts

Setting up book-keeping based on company needs.

Setting up book-keeping based on company needs.

Recorded Account

Recorded

Account

Collecting all receipts file in electronic book-keeping.

Collecting all receipts file in electronic book-keeping.

Financial Report

Financial

Report

Preparation of financial reports, including: balance sheet, income statement, etc.

Preparation of financial reports, including: balance sheet, income statement, etc.

File Tax Returns

File Tax

Returns

Company Income Tax, Business Tax, VAT, Personal Income Tax declaration.

Company Income Tax, Business Tax, VAT, Personal Income Tax declaration.

Year-end Accounts

Year-end

Accounts

Coping With accounting details for preparing Annual Audit and Tax Declaration.

Coping With accounting details for preparing Annual Audit and Tax Declaration.

Annual Audit

Annual

Audit

Annual Audit/ Annual Inspection. (Some areas need extra Audit Report.)

Annual Audit/ Annual Inspection. (Some areas need extra Audit Report.)

V.China Agent Billing Service

For every company in China, bookkeeping is a primary consideration. Differences between Chinese and international accounting standards may lead to misunderstandings of the law and may cause financial losses to the company.

In China, it is common for many SMEs to outsource bookkeeping. After the company starts to use the agency bookkeeping service, there is no need to worry about training, and it can obtain more accurate accounting information at a lower cost and obtain more professional results.

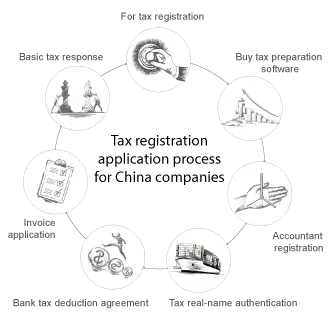

| Chinese company tax registration application process |

1.For tax registration. 2.Buy tax preparation software. 3.Accountant registration. 4.Tax real-name authentication. 5.Bank tax deduction agreement. 6.Invoice application. 7.Basic tax response.

VI.One more step to experience the differentiation of services

The policies announced by the local finance and taxation departments are closely related to enterprises. How to pay attention to the policy trend, cross-border operators often have delays in the information in this part.

Inter Area provides local professionals with real-time communication and cross-border services, obtaining timely returns on information, and is committed to improving the standardization of accounting services and SOP for accounting information communication to reduce unnecessary time and cost losses, thereby eliminating gaps and obstacles in cross-border tax information, and continuously improve the efficiency and value of services, provide customers with real-time and accurate local tax and financial information and propose practical solutions, and meet the needs of investors and other financial information users by enriching practical operations and professional knowledge.