Seychelles Company Registration

Seychelles was originally....

British Virgin Islands Company Registration

The British Virgin Islands...

Hong Kong Company Registration

Hong Kong combines...

Taipei

TEL:+886-2-2557-5607

Taichung

TEL:+886-4-2320-2793

Shanghai

TEL:+86 21-6090-4391

Shenzhen

TEL:+86 755-83176807

The UK company has a high international legal status and a good image and is the registered place of most offshore companies in the world.

With the development trend of international commercialization, more and more companies set up offshore companies to expand their operations and expand overseas business. It is very important to choose the right place of registration.

Registering a UK offshore company enjoys many advantages, a stable economic system, sound and complete company regulations, and a clear tax system, enabling the company to operate well.

I.UK Company Introduction

The United Kingdom is made up of islands off the northwest coast of Europe. These include England, Scotland, Wales and Northern Ireland.

The country name is “The United Kingdom of Great Britain and Northern Ireland” (The United Kingdom of Great Britain and Northern Ireland), the capital is London, the United Kingdom has an advanced open market economy and a good image, and is the leading center of international finance and banking and insurance.

As an important trading entity, it has considerable economic, cultural, military, scientific, technological and political influence in the world.

After the UK leaves the EU in 2020, the UK’s foreign investment status has not declined. Looking at the distribution of IMF’s global net direct investment, the UK’s net FDI in 2020 will reach 53.1 billion, which is significantly better than that of the EU and remains ranked fourth in the world, second to China , the United States and Ireland, with financial services and professional technology as the main foreign investment projects in the United Kingdom.

The UK is the sixth largest economy in the world and one of the countries with the most developed economy and the highest standard of living in the world.

- Location

The United Kingdom is composed of Great Britain (including England, Scotland,Wales), the northeastern part of the island of Ireland and some small islands around it. It faces the European mainland across the North Sea, the Strait of Dover, and the English Channel. It covers an area of 244,100 square kilometres and is located in mid-latitudes, with a temperate maritime climate.

- Population

67,886,011。

- Language

The language is mainly English, and other local languages include Scots, Welsh, Irish and so on.

- Foreign Exchange Control

None.

- Economics

Banking, finance, shipping, insurance, and business services account for the largest proportion of GDP. In a leading position in the world, the capital London is one of the world’s leading financial, shipping and service centers.

- Currency

GBP(£)。

- Time Zone

UTC+1 (UK standard time)

- Main Company Legislation

British company law.

Population

67,886,011

Legal System

Common law

GBP (£)

Currency

UTC+1

Time Zone:UTC+1

(UK standard time)

Main Company Legislation

British Company Law

None

Foreign Exchange Control

The United Kingdom is made up of islands off the northwest coast of Europe. These include England, Scotland, Wales and Northern Ireland. The country name is “The United Kingdom of Great Britain and Northern Ireland” (The United Kingdom of Great Britain and Northern Ireland), the capital is London, the United Kingdom has an advanced open market economy and a good image, and is the leading center of international finance and banking and insurance. As an important trading entity, it has considerable economic, cultural, military, scientific, technological and political influence in the world.

After the UK leaves the EU in 2020, the UK’s foreign investment status has not declined. Looking at the distribution of IMF’s global net direct investment, the UK’s net FDI in 2020 will reach 53.1 billion, which is significantly better than that of the EU and remains ranked fourth in the world, second to China , the United States and Ireland, with financial services and professional technology as the main foreign investment projects in the United Kingdom. The UK is the sixth largest economy in the world and one of the countries with the most developed economy and the highest standard of living in the world.

- Location

The United Kingdom is composed of Great Britain (including England, Scotland,Wales), the northeastern part of the island of Ireland and some small islands around it. It faces the European mainland across the North Sea, the Strait of Dover, and the English Channel. It covers an area of 244,100 square kilometres and is located in mid-latitudes, with a temperate maritime climate.

- Language

The language is mainly English, and other local languages include Scots, Welsh, Irish and so on.

- Economics

Banking, finance, shipping, insurance, and business services account for the largest proportion of GDP. In a leading position in the world, the capital London is one of the world’s leading financial, shipping and service centers.

II.UK company registration type

There are many different types of UK companies to choose from, LTD(Limited company), LLP(Limited liability partnership) and PLC(Public limited company). Before setting up a company outside the UK, you can learn more about the types of registration of different UK companies.

- Limited Company (The most common type of company)

- Only one shareholder is required, and he can also be the sole director.

- Meetings not required: The government does not require meetings of any kind.

- There is no minimum share capital.

- Limited Liability Partnership (LLP)

- The minimum number of members is 2 people.

- As long as their income is not from with in the UK, they are not subject to income tax/corporate tax.

- The UK limited liability partnership is not required to declare a minimum legal capital.

- Must have an office address.

- Public Limited Company (PLC)

- Also called a listed company.

- Only one shareholder and two directors are required to establish it.

- Completely owned by foreigners.

- There are two minimum share capital.

III.Advantages and established uses

The Solid legal system and stable financial environment mean that investors are well protected in the UK, and UK companies have the following advantages:

- 1. UK company registration process is simple: only one shareholder is required and capital is not required.

- 2. Tax exemption for overseas income.

- 3. The UK company can open an account at any bank in the world (no other foreign company’s account opening restrictions).

- 4. Consider “legal” tax planning and focus on “brand image”.

- 5. The role of “broker” increases the legal validity of the agreement contract, such as commission, royalties, copyright fees, engineering funds, research and development funds, etc.

- 6. Compared with setting up a company in the UK, there is no need to worry about being difficult to win the trust of the tax authorities of developed countries with other “tax-free havens”, which affects the willingness of customers to place orders.

- 7. Local visa application: You can apply for an entry visa for the responsible person through a UK company, such as an independent representative visa. After five years of extension, you can further apply for UK permanent residence if you meet the conditions.

IV.Basic rules for UK companies

- Minimum number of individual directors/shareholders: 1.

- No need for local company directors.

- Public Directors List.

- Requires annual tax return.

- Annual accounts.

- Need to convene an annual general meeting of shareholders.

- Venue of annual general meeting:anywhere.

- Zero paid-in capital.

V.UK company registration process and required documents

The registration procedure is as follows:

- Step one : Proposed registered company name

It needs to end with Limited, Ltd. It cannot end with a trust company, bank, or other similar words unless the company has obtained the corresponding license locally.

- Step 2 : The following documents are required for UK company registration:

1. Taiwanese address in English.

2. Register at least one director and one shareholder’s passport copy (the same person).

3. For registration, a copy of the secretary’s passport (regardless of nationality) is required.

4. The directors and shareholders of the company must provide proof of address for the past three months (such as bank statements, receipts for water, electricity and telephone bills).

5. The standard registered capital for UK company registration is £1,000-£1,000,000 (if the capital is higher than £1 million, an additional 5/1000 stamp fee will be paid).

- Step 3 : Complete the company registration questionnaire

Complete the company registration questionnaire and the company’s business scope (main business).

- Step 4 : Choose an agent (secretary company)

Choose an agent (secretary company) to submit the application to the UK registry for you, and obtain the license and company documents.

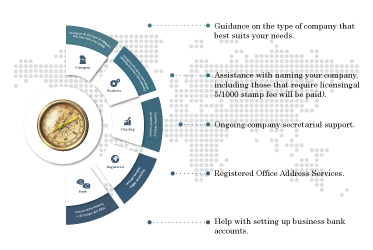

VI.Services provided by agents (secretary companies)

- Most secretarial companies can provide you with professional expert advice and assistance to register your company and provide:

- Guidance on the type of company that best suits your needs.

- Assistance with naming your company, including those that require licensing.

- Ongoing company secretarial support.

- Registered Office Address Services.

- Help with setting up business bank accounts.

- Guidance on the type of company that best suits your needs.

- Assistance with naming your company, including those that require licensing.

- Ongoing company secretarial support.

- Registered Office Address Services.

- Help with setting up business bank accounts.

VII.Follow-up maintenance of UK companies: Is annual review required? What are the requirements for annual review?

- All UK companies, whether trading or not, are required to submit annual accounts and confirmation statements, including dormant companies.

- Every year (at least every 12 months) UK companies need to submit an Annual Return to Company House (“CH”). The annual audit report must be submitted within 28 days from the company’s anniversary date.

- What are the documents required for the annual review of a UK company?

– Proof of company registration.

– Scanned copies of ID cards of shareholders and directors.

– Company business registration certificate.

– The articles of association of a UK company.

– If the company has changed shareholders, increased capital, etc., it is also necessary to provide relevant documents.

- Registering a UK company must note that CH reserves the legal right to pursue the person in charge of the UK company registration who does not submit an annual review, and the violation is criminal law.

- Generally speaking, qualified small companies are entitled to audit exemption, but if the small company belongs to the categories of listed companies, group subsidiaries, banks, insurance, etc., they are not exempt from audit exemption.